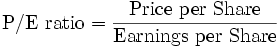

The P/E ratio of a stock (also called its "earnings multiple", or simply "multiple", "P/E", or "PE") is used to measure how cheap or expensive its share prices is. The lower the P/E, the less you have to pay for the stock, relative to what you can expect to earn from it. It is a valuation ratio included in other financial ratios.

The price per share (numerator) is the market price of a single share of the stock. The earnings per share (denominator) is the net income of the company for the most recent 12 month period, divided by number of shares outstanding. The EPS used can also be the "diluted EPS" or the "comprehensive EPS"

For example, if stock A is trading at $24 and the Earnings per share for the most recent 12 month period is $3, then the P/E ratio is 24/3=8. Stock A said to have a P/E of 8 (or a multiple of 8). Put another way, you are paying $8 for every one dollar of earnings.

It is probably the single most consistent red flag to excessive optimism and over-investment. It also serves, regularly, as a marker of business problems and opportunities. By relating price and earnings per share for a company, one can analyze the market's valuation of a company's shares relative to the wealth the company is actually creating.

One reason to calculate P/Es is for investors to compare the value of stocks, one stock with another. If one stock has a P/E twice that of another stock, it is probably a less attractive investment. But comparisons between industries, between countries, and between time periods may be dangerous. To have faith in a comparison of P/E ratios, one should compare comparable stocks.

See Also: Value Investing , Active Portfolio Management , Price-to-Book Ratio , Book Value in Stock-Market ,

No comments:

Post a Comment