Friday, December 29, 2006

Bulls make money, bears make money, but pigs just get slaughtered

On Wall Street, the bulls and bears are in a constant struggle. If you haven't heard of these terms already, you undoubtedly will as you begin to invest.

The Bulls

A bull market is when everything in the economy is great, people are finding jobs, gross domestic product (GDP) is growing, and stocks are rising. Things are just plain rosy! Picking stocks during a bull market is easier because everything is going up. Bull markets cannot last forever though, and sometimes they can lead to dangerous situations if stocks become overvalued. If a person is optimistic and believes that stocks will go up, he or she is called a "bull" and is said to have a "bullish outlook".

The Bears

A bear market is when the economy is bad, recession is looming and stock prices are falling. Bear markets make it tough for investors to pick profitable stocks. One solution to this is to make money when stocks are falling using a technique called short selling. Another strategy is to wait on the sidelines until you feel that the bear market is nearing its end, only starting to buy in anticipation of a bull market. If a person is pessimistic, believing that stocks are going to drop, he or she is called a "bear" and said to have a "bearish outlook".

The Other Animals on the Farm - Chickens and Pigs

Chickens are afraid to lose anything. Their fear overrides their need to make profits and so they turn only to money-market securities or get out of the markets entirely. While it's true that you should never invest in something over which you lose sleep, you are also guaranteed never to see any return if you avoid the market completely and never take any risk,

Pigs are high-risk investors looking for the one big score in a short period of time. Pigs buy on hot tips and invest in companies without doing their due diligence. They get impatient, greedy, and emotional about their investments, and they are drawn to high-risk securities without putting in the proper time or money to learn about these investment vehicles. Professional traders love the pigs, as it's often from their losses that the bulls and bears reap their profits.

What Type of Investor Will You Be?

There are plenty of different investment styles and strategies out there. Even though the bulls and bears are constantly at odds, they can both make money with the changing cycles in the market. Even the chickens see some returns, though not a lot. The one loser in this picture is the pig.Make sure you don't get into the market before you are ready. Be conservative and never invest in anything you do not understand. Before you jump in without the right knowledge, think about this old stock market saying:"Bulls make money, bears make money, but pigs just get slaughtered!"

Sunday, December 17, 2006

Return on Equity

Return on Equity (ROE, Return on average common equity) measures the rate of return on the ownership interest (shareholders' equity) of the common stock owners. ROE is viewed as one of the most important financial ratios. It measures a firm's efficiency at generating profits from every dollar of net assets, and shows how well a company uses investment dollars to generate earnings growth. ROE is equal to a fiscal year's net income (after preferred stock dividends but before common stock dividends) divided by total equity (excluding preferred shares), expressed as a percentage.

Return on equity reveals how much profit a company earned in comparison to the total amount of shareholder equity found on the balance sheet.

A business that has a high return on equity is more likely to be one that is capable of generating cash internally. For the most part, the higher a company’s return on equity compared to its industry, the better.

If you owned a business that had a net worth [shareholder’s equity] of $100 million dollars and it made $5 million in profit, it would be earning 5% on your equity [$5 / $100 = .05, or 5%]. The higher you can get the “return” on your equity, in this case 5%, the better.

Why Warren Buffet Says "Focus on return on equity, not, earning per share". ?

Return on equity is particularly important because it can help you cut through the garbage spieled out by most CEO’s in their annual reports about, “achieving record earnings”. Warren Buffett pointed out years ago that achieving higher earnings each year is an easy task. Why? Each year, a successful company generates profits. If management did nothing more than retain those earnings and stick them a simple passbook savings account yielding 4% annually, they would be able to report “record earnings” because of the interest they earned. Were the shareholders better off? Not at all; they would have enjoyed heftier returns had the earnings been paid out. This makes obvious that investors cannot look at rising per-share earnings each year as a sign of success. The return on equity figure takes into account the retained earnings from previous years, and tells investors how effectively their capital is being reinvested. Thus, it serves as a far better gauge of management’s fiscal adeptness than the annual earnings per share.

google8d9233e6f105e5dc.html

Friday, December 15, 2006

Quotes By Greatest Investor Warren Buffet

here are some of the valuable insights of the stock market success by the legendory investor and chairman of Berkshire Hathaway,who has amassed billions of $ by investing in stock market.These quotes by Warren Buffet would help everyone from beginer to seasoned investor in getting rich by investing in stock market.

- The critical investment factor is determining the intrinsic value of a business and paying a fair or bargain price.

- Stop trying to predict the direction of the stock market, the economy, interest rates, or elections.

- Be fearful when others are greedy and greedy only when others are fearful.

- It is optimism that is the enemy of the rational buyer.

- Focus on return on equity, not, earning per share.

- Never invest in a business you cannot understand.

- An investor should ordinarily hold a small piece of an outstanding business with the same tenacity that an owner would exhibit if he owned all of that business.

- Does the business have a consistent operating history?

- Always invest for the long term.

- Wide diversification is only required when investors do not understand what they are doing.

Saturday, December 09, 2006

Fundamental Analysis

The objectives of the analysis may be to calculate credit risk, to evaluate management and make internal business decisions, or to determine the value of a company's stock and its probable future. The analysis is performed on historical and present data, but the objective is to predict future stock or business performance.

Two analytical models:When the objective of the analysis is to determine what stock to buy and at what price, there are two basic methodologies.

Fundamental analysis maintains that markets may misprice a security in the short run but that the "correct" price will eventually be reached. Profits can be made by trading the mispriced security and then waiting for the market to recognize its "mistake" and reprice the security. Even if the investor believes he cannot beat the market index, he may still pick stock for the challenge, for the fun of trying, and for the ego rush when he does beat the market.

Technical analysis maintains that all information is reflected already in the stock price, so fundamental analysis is a waste of time. Trends 'are your friend' and sentiment changes predate and predict trend changes. Investors' emotional responses to price movements lead to recognizable price chart patterns. Technical analysis does not care what the 'value' of a stock is. Their price predictions are only extrapolations from historical price patterns.

Investors can use both these different but somewhat complementary methods for stock picking. Many fundamental investors use technicals for deciding entry and exit points. Many technical investors use fundamentals to limit their universe of possible stock to 'good' companies.

The choice of stock analysis is determined by the investor's belief in the different paradigms for "how the stock market works".

Financial Calculators

- Compound Interest

- Present Value

- Rate of Return

- Annuity

- Bond Yield

- Mortgage

- Retirement.

Monday, December 04, 2006

What is Book Value In Stock Market

as a 'per share' value': The balance sheet Equity value is divided by the number of shares outstanding at the date of the balance sheet (not the average o/s in the period).

as a 'diluted per share value': The Equity is bumped up by the exercise price of the options, warrants or preferred shares. Then it is divided by the number of shares that has been increased by those added.

See Also: Value Investing , Price-to-Book Ratio , Active Portfolio Management , P/E Ratio

Book Value & Price-to-Book Ratio

A lower P/B ratio could mean that the stock is undervalued. However, it could also mean that something is fundamentally wrong with the company. As with most ratios, be aware this varies a fair amount by industry. Industries that require higher infrastructure capital (for each dollar of profit) will usually trade at P/B much lower than the P/B of (e.g.) consulting firms.

This ratio also gives some idea of whether you're paying too much for what would be left if the company went bankrupt immediately. For companies in distress the book value is usually calculated without the intangible assets that would have no resale value. In such cases P/B should also be calculated on a 'diluted' basis, because stock options may well vest on sale of the company or change of control or firing of management.

See Also: Value Investing , P/E Ratio , Active Portfolio Management , BV in Stock Market

Sunday, December 03, 2006

P/E RATIO

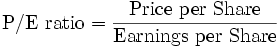

The P/E ratio of a stock (also called its "earnings multiple", or simply "multiple", "P/E", or "PE") is used to measure how cheap or expensive its share prices is. The lower the P/E, the less you have to pay for the stock, relative to what you can expect to earn from it. It is a valuation ratio included in other financial ratios.

The price per share (numerator) is the market price of a single share of the stock. The earnings per share (denominator) is the net income of the company for the most recent 12 month period, divided by number of shares outstanding. The EPS used can also be the "diluted EPS" or the "comprehensive EPS"

For example, if stock A is trading at $24 and the Earnings per share for the most recent 12 month period is $3, then the P/E ratio is 24/3=8. Stock A said to have a P/E of 8 (or a multiple of 8). Put another way, you are paying $8 for every one dollar of earnings.

It is probably the single most consistent red flag to excessive optimism and over-investment. It also serves, regularly, as a marker of business problems and opportunities. By relating price and earnings per share for a company, one can analyze the market's valuation of a company's shares relative to the wealth the company is actually creating.

One reason to calculate P/Es is for investors to compare the value of stocks, one stock with another. If one stock has a P/E twice that of another stock, it is probably a less attractive investment. But comparisons between industries, between countries, and between time periods may be dangerous. To have faith in a comparison of P/E ratios, one should compare comparable stocks.

See Also: Value Investing , Active Portfolio Management , Price-to-Book Ratio , Book Value in Stock-Market ,

Saturday, December 02, 2006

Active Portfolio Management

But if your answer is yes, it is possible to beat the market, then you should pursue active portfolio management. Among the arguments for this approach are the possibility that there are a variety of anomalies in securities markets that can be exploited to outperform passive investments, the likelihood that some companies can be pressured by investors to improve their performance , and the fact that many investors and managers have outperformed passive investing for long periods of time.

But the active investor must still face the challenge of outperforming a passive strategy. Essentially, there are two sets of decisions. The first is asset allocation, where you carve up your portfolio into different proportions of equities, bonds and other instruments.These decisions, often referred to as market timing as investors try to reallocate between equities and bonds (see FIXED INCOME) in response to their expectations of better relative returns in the two markets, tend to require macro forecasts of broad-based market movements .

Then there is security selection - picking particular stocks or bonds. These decisions require micro forecasts of individual securities underpriced by the market and hence offering the opportunity for better than average returns.

Active investing involves being 'overweight' in securities and sectors that you believe to be undervalued and 'underweight' in assets you believe to be overvalued. Buying a stock, for example, is effectively an active investment that can be measured against the performance of the overall market.Compared to passive investing in a stock index, buying an individual stock combines an asset allocation to stocks and an active investment in that stock in the belief that it will outperform the stock index.

In both market timing and security selection decisions, investors may use either technical or fundamental analysis (see TECHNICAL ANALYSIS, VALUE INVESTING and GROWTH INVESTING). And you can be right in your asset allocation and wrong in your active security selection and vice versa. It is still possible that an investor who makes a mistake in asset allocation, perhaps by being light in equities in a bull market, can still do well by picking a few great stocks.

There are arguments for both active and passive investing though it is probably the case that a larger percentage of institutional investors invest passively than do individual investors. Of course, the active versus passive decision does not have to be a strictly either/or choice. One common investment strategy is to invest passively in markets you consider to be efficient and actively in markets you consider less efficient. Investors can also combine the two by investing part of a portfolio passively and another part actively.

See Also: Value Investing , Price-to-Book Ratio , P/E Ratio , BV in Stock Market